2018 GST distribution legislation

On this page

Introduction

In 2018, the Parliament of Australia legislated a new way to distribute GST revenue among the states and territories (states).

The key elements are:

- a new equalisation benchmark linked to the fiscally stronger of NSW or Victoria

- a GST relativity floor

- Commonwealth funded top-ups to the GST pool

- transitional arrangements, staging implementation of the new equalisation benchmark and giving states a no-worse off guarantee.

A new equalisation benchmark

Since introducing the GST in 2000, the Commonwealth has distributed the revenue among the states. Because they have different service delivery needs and abilities to raise revenue, a different amount of GST per person is allocated to each state. It seeks to put all Australians on a level playing field in terms of their potential to access services and infrastructure. This is referred to as fiscal equalisation.

The per person GST share is expressed as a ‘GST relativity’. If all states had the same fiscal capacity, each would have a GST relativity of 1 and receive the same GST per person. States’ needs are different. Fiscally stronger states have a GST relativity below 1 (and receive less than the average GST per person). Fiscally weaker states have a GST relativity above 1 (and receive more than the average GST per person).

The 2018 legislation ensures that each state’s GST relativity is at least as high as the relativity of the fiscally stronger of New South Wales or Victoria (referred to as the ‘standard state’). This means no state will receive less GST per person than the standard state.

Should any state be fiscally stronger than the standard state (that is, have a lower relativity than the standard state), its relativity is increased to the relativity of the standard state. Given the GST is distributed from a fixed funding pool, other states’ relativities fall to accommodate this increase.

A GST relativity floor

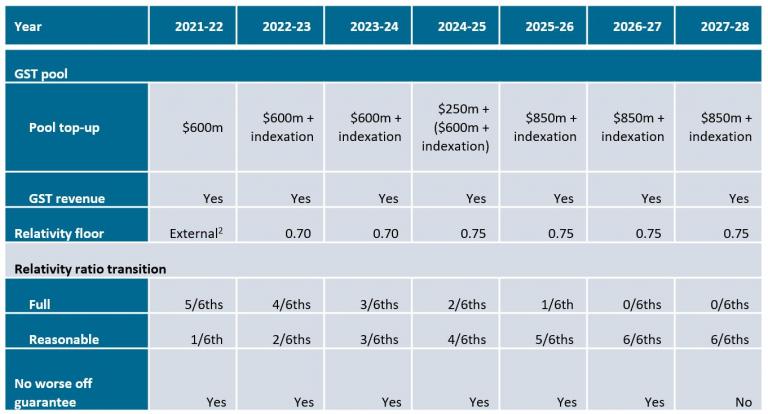

The GST floor sets a relativity below which a state’s GST share cannot fall. It creates a minimum per person GST share that each state receives, irrespective of its fiscal circumstances. Since 2024-25, the floor has been 0.75.

While the floor is a permanent feature of the new arrangements, it is unlikely to be needed from 2026-27. The new benchmark is expected to provide each state with a minimum GST per person that is more than that provided by the floor.

GST pool top-up

The Commonwealth topped-up the GST pool by $600 million in 2021-21. This top-up continues in each following year, with indexation. In 2024-25 the GST pool was supplemented with a further $250 million with indexing of both amounts continuing in subsequent years.1

Transitional arrangements

The transition to the new equalisation arrangements commenced in 2021-22 and will conclude in 2026-27.

During the 6 year transition, GST relativities are a blend of the old and new arrangements. For 2021-22, each state’s GST relativity was based on 5/6 of its GST relativity under the old arrangements and 1/6 of its relativity under the new arrangements. For 2022-23, the split was 4/6 and 2/6, and so on. By 2026-27, GST distribution will fully reflect the new equalisation benchmark.

A ‘no worse off’ guarantee operates during the transitional period. This ensures that, over the transitional period, no state will receive a lower cumulative amount of GST than it would have received under the previous arrangements. No worse-off payments are funded by the Commonwealth Government outside of the GST pool. The legislated no worse off guarantee operates from 2021–22 until 2026–27. Under an agreement between the Commonwealth and the states, no worse off payments will continue until 2029–30

Table 1 Summary of the transition by year

1 2027-28 is the first year following the completion of the transition period.

2 The Commonwealth is directly funded the cost of the floor in 2021-22. After 2021-22, the floor has continued to be funded from within the GST pool.

Productivity Commission Review

On 24 September 2025, terms of reference for the Productivity Commission Inquiry were released.

The inquiry will examine the extent that the 2018 changes to the GST distribution system are operating efficiently, effectively and as intended, and the fiscal implications of the changes for each state and territory and the Commonwealth.

The Productivity Commission will provide an interim report to Government by 28 August 2026 and a final report before 31 December 2026.